Qablet

Qablet's timetable technology allows you to analyze a variety of financial contracts, with a fraction of the development cost usually associated with complex payoffs and complex models.

What is Qablet?

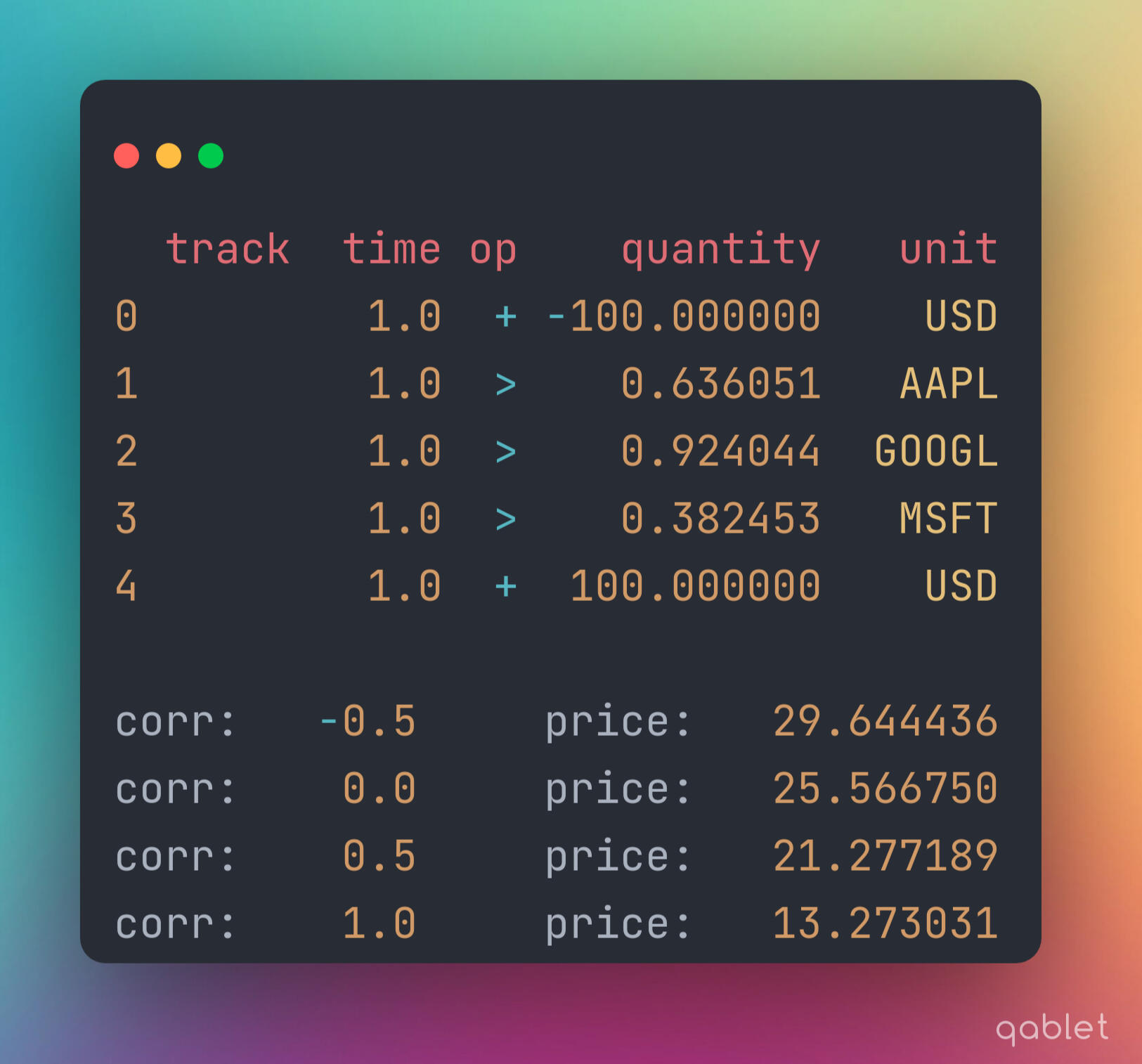

A Qablet timetable defines a financial contract using a sequence of payments, choices and conditions. Qablet allows you to define your own contract, and value it using any of the qablet models. You can also create your own model and use it to value any qablet contract.

Plug and Play

You can focus on your model features. Do not worry about adapting it to every contract in your portfolio.

Simple and Visual

A Qablet timetable is easy to visualize, store, and interoperable with multiple languages.

Community

Share ideas with the community and learn from theirs.

Many ways to learn

A learning path with a series of Jupyter Notebooks.

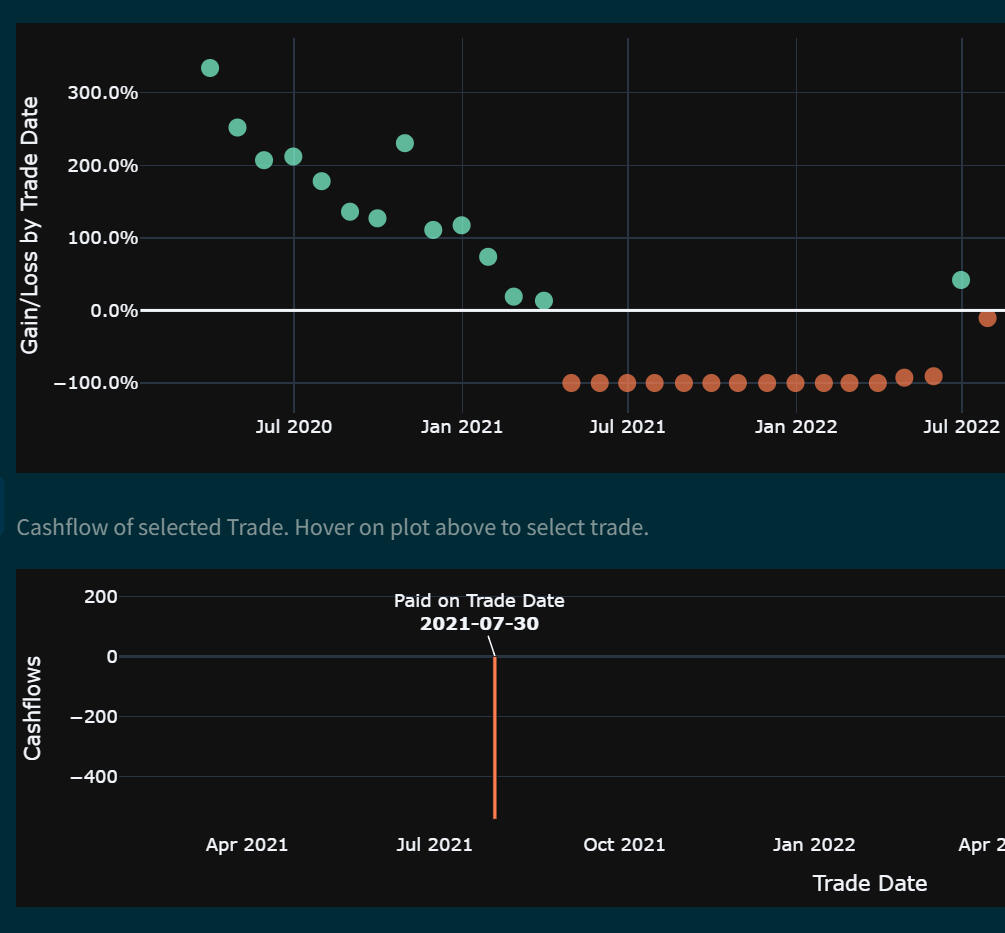

A Interactive application that analyzes various contracts.

API documentation of the Qablet specification language.

Features

Basic

Payments, Options, Tracks, and path dependent payoffs

PDE and Monte Carlo Models

Customize Monte Carlo Models.

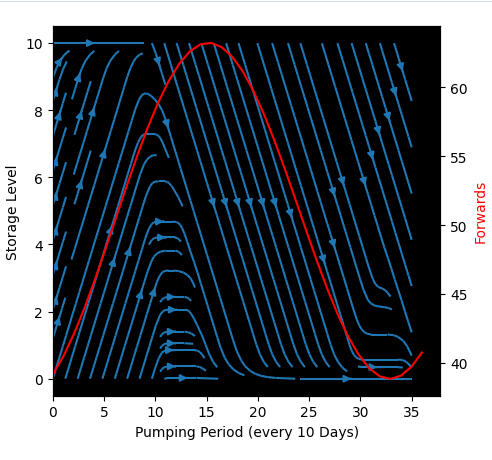

Model audit for paths and exercise decisions.

Advanced

Conditionals

Batch Transitions

American Monte-Carlo

Portfolio Simulation.

Send us a Message

Stay informed about case studies and new features.

© Qablet Inc. All rights reserved.